tax is theft bitcoin

As I see it. Bitcoins Early Years.

Taxation Is Theft Archives Bitcoin News

Please login or register.

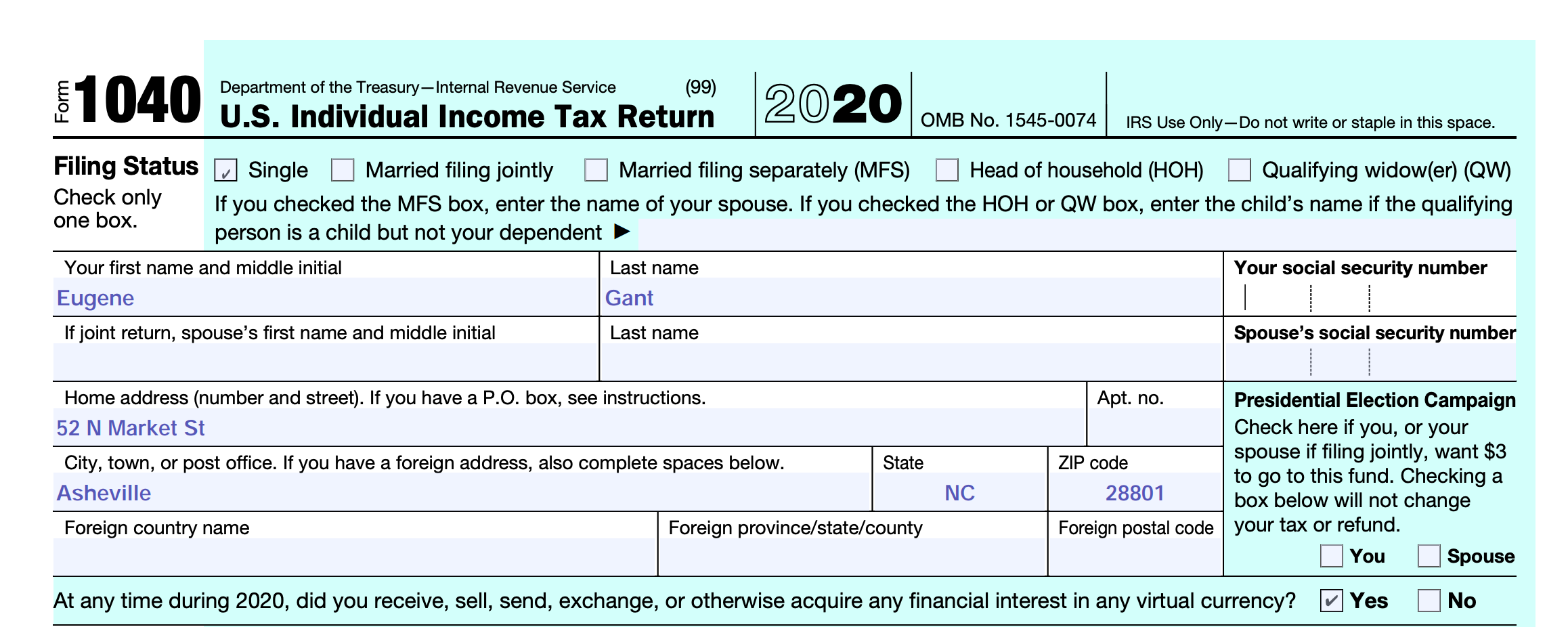

. Its a long-term gain taxed at a rate of either 0 15 20 depending on your overall income if you owned the Bitcoin for. If you have suffered losses as the result of theft. But how much tax do you have to pay.

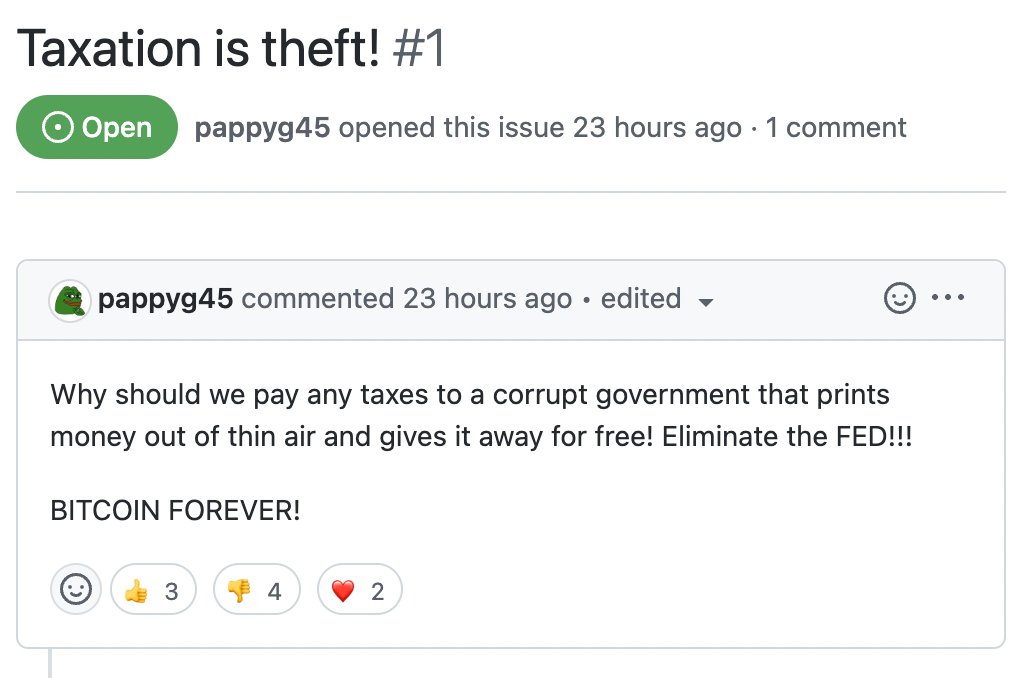

Latest Bitcoin Core release. If you look at Bitcoins pricing data on Google Finance it only goes back to Nov. Fraud scams and outright theft.

Tax is theft bitcoin Sunday June 26 2022 Edit. 12ANDERSON The former food service manager for Anderson Community Schools has agreed to plead guilty to federal charges of wire fraud and filing false tax forms in the theft of about. New York defines bitcoin sales tax the same way by finding the value of the cryptocurrency or CVC used at the time of purchase and applying that to the value of the CVC amount spent.

Cryptocurrency Is Treated As Property For. To arrive at the deductible amount 100 plus 10 of your Adjusted Gross. April 12 2022 045942 PM.

SAN JOSE Calif. Casualty Loss - ex. Bitcoins with US tax form 1040.

Crypto theft and scams are on the rise but only some of these losses are tax-deductible. BitcoinTax is the most established crypto tax calculation service that can work out your capital gains and losses and produce the data and forms you need to file your taxes. You then sell it for 50000 so you have a 20000 capital gain.

This would be a short-term gain if you held the Bitcoin for one year or less and it would be taxed as ordinary income according to your tax bracket. ExchangeWallet Hacked Stolen Coins Investment Loss - Gray area ex. Tax attorney Steven Chung shares how fraud victims can use theft loss deductions to offset ordinary income.

Now he admitted that for the higher tax brackets the amount added by the company doesnt compensate for your entire tax burden but at lower levels it accounts for most of it. If you owned your bitcoin for more than a year you will pay a long-term capital gains tax rate on your profit which is determined by. Similarly theft losses used to be tax deductible.

Lost Wallet Access Sent to Wrong Address Theft Loss - ex. They are now no longer tax deductible. Taxes are theftare they.

Tax form pay concept. The point of saying that taxation is theft is to remind people that it may be a necessary evil to pay for police roads etc but still an evil so has to be minimised. Lets take a look at how to report stolen scammed and lost tokens on your taxes.

Golden Bitcoin on tax form. Tax Rules for Bitcoin and Others. However theft losses were also affected in the tax reform.

The tax code only allows you to write-off a portion of your theft loss as opposed to the full amount. In this scenario your cost basis is 10000 and your gain is 5000. KGO -- Most losses from theft fire storms and accidents are no longer deductible on federal tax returns due to changes in the Trump administrations Tax Cuts.

The growth in BTC adoption in the early years started slow. Bitcoin became a news sensation in 2017 when its value skyrocketed. In all cases organized books and records are a necessity.

Your gain is the amount youll be obliged to pay taxes on. So if youve lost your crypto. Under the current tax law this situation is a personal casualty loss which is no longer tax-deductible.

If cryptocurrency such as Bitcoin is stolen by hackers tax relief may also be available.

Molly White On Twitter Senators Lummis And Gillibrand Put The Text Of Their Proposed Crypto Legislation On Github And The First Comment Is From A Person With A Pepe Avatar Writing Taxation

Do You Pay Tax On Lost Stolen Or Hacked Crypto Koinly

Cryptocurrency Tax Guide 2022 How Is Crypto Taxed In The Us

Coinbase And Turbotax Users Can Now Accept Tax Return In Crypto

Crypto Tax 2021 A Complete Us Guide Coindesk

U S Seizes 3 6 Billion In Stolen Bitcoin Btc From Bitfinex Hack Bloomberg

Do You Pay Tax On Lost Stolen Or Hacked Crypto Koinly

How Doj Tracked Down The Bitcoin Stolen In Bitfinex Hack Time

On Crypto Tax Investors And Experts Have More Questions Than Answers The Economic Times

Your Crypto Tax Guide Turbotax Tax Tips Videos

Crypto Tax Accounting 2022 How To Report Cryptocurrency Taxes

Cryptocurrency Taxes What To Know For 2021 Money

Crypto Tax Accounting 2022 How To Report Cryptocurrency Taxes

Is Bitcoin Safe To Invest In Nextadvisor With Time

10 Of Americans Used Bitcoin To Ignore Identity Theft

Japanese Bitcoin Law Lenz Karl Friedrich 9781502353030 Amazon Com Books

:max_bytes(150000):strip_icc()/cryptocurrency.asp-final-11275c98371247efad3e5179ae6e7d7e.jpg-75078b39349443e7bb412213be0c6dc3.jpg)